COMPANY FORMATION IN THE PHILIPPINES: OPTIONS FOR COMPANY INCORPORATION

Local and foreign investors can conduct business in the Philippines by registering any of the following business entities: sole proprietorship, partnership, corporation or cooperative. If you want to register a corporation, you can choose between two options: incorporating a new domestic company or obtaining a license for a foreign company to operate in the Philippines.

Each type of business entity has its own incorporation and registration process, paid-up capital requirements, tax obligations, ownership structure, and startup costs. Additionally, the list of government agencies you should coordinate with will vary depending on the type of business entity you want to register.

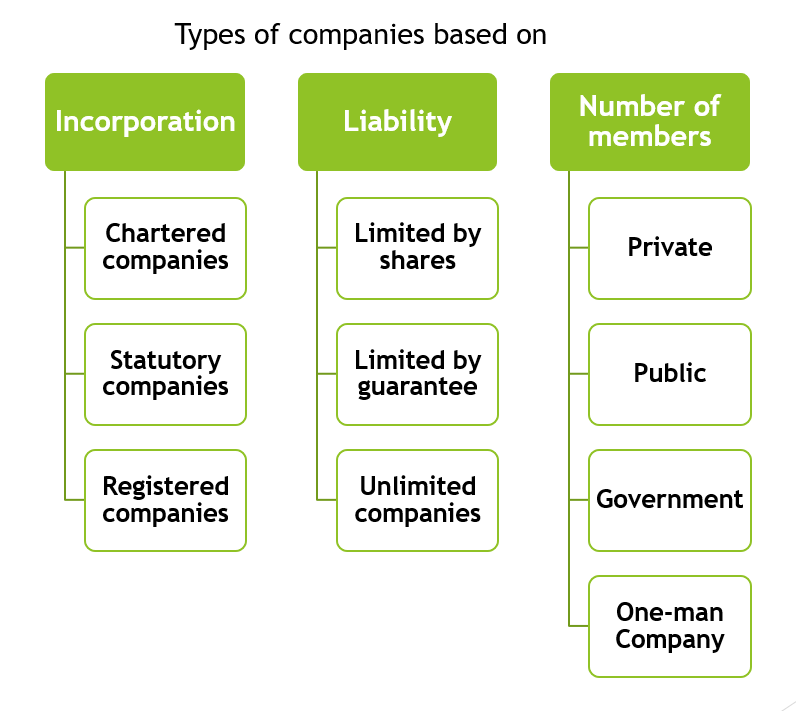

TYPES OF BUSINESS ENTITIES IN THE PHILIPPINES

INVESTMENT VEHICLE: CORPORATION

Types:

- Stock Corporation – a corporation with capital stock divided into shares and authorized to distribute to the holders of such shares, dividends or allotments the profits of the business based on equity of shares

- Domestic Corporation (organized under Philippine laws)

- 100% Filipino-owned

- 60% Filipino-owned and 40% Foreign-owned

- 40.01% to 100% Foreign-owned (subject to certain provisions under Foreign Investments Act)

- Foreign Corporation (organized under the laws of the corporation’s country of origin)

- Branch Office

- Representative Office

- Regional Area Headquarters (RHQ)

- Regional Operating Headquarters (ROHQ)

- Domestic Corporation (organized under Philippine laws)

- Non-Stock Corporation – a corporation that neither generates profit nor issues shares of stock to its members, and could have any of the following purposes:

- Charitable;

- Religious;

- Educational;

- Cultural;

- Civic service; and

- Other similar purposes, such as chambers or combinations trade, industry or agriculture

Ownership Structure:

- Domestic corporations are required to be formed by at least five (5) but not more than fifteen (15) incorporators who must have individual subscriptions of at least one (1) share in the company; incorporators are stockholders or members mentioned in the Articles of Incorporation as originally forming and composing the corporation and are signatories thereof

- For a foreign corporation to be granted a License to Operate in the Philippines as a business entity, it is required to appoint one (1) resident agent who shall accept all summons or legal processes served, arising out of any business or transaction which occurred in the Philippines, to the corporation

Government Agencies Involved in the Registration Process:

- Securities and Exchange Commission (SEC) (for the creation of juridical entity of the corporation)

- Bureau of Internal Revenue (BIR) (for corporate taxation)

- Local Government Units (LGUs) of the location where you want to establish your business

- Barangay Hall

- Mayor’s Office

- Business Permit and Licensing Office (BPLO) of the Municipal/City Hall

- If employing individuals, a corporation should register with the following agencies:

- Social Security System (SSS)

- Philippine Health Insurance Corporation (PhilHealth)

- Home Development Mutual Fund (Pag-IBIG Fund)

*See table below for companies requiring endorsements from other government agencies

INVESTMENT VEHICLE: PARTNERSHIP

Types:

- General Partnership – a business arrangement where two or more people, usually referred to as general partners, agree to share among themselves all assets, profits, and financial and legal liabilities of the business; the general partners can take part in the daily management of the partnership and each has unlimited liability for the actions of the partnership, including the actions of other partners

- Limited Partnership – a type of partnership where the partners, usually referred to as limited partners, are only held liable to the extent of their investment in the partnership; unlike general partnerships, the limited partners have no management authority or input towards the operations of the company

Ownership Structure:

- Can be formed by two (2) or more individuals who agree to do business together for profit

Government Agencies Involved in the Registration Process:

- SEC or Department of Trade and Industry (DTI) (for the creation of juridical entity of the partnership; registration depends on the capital of the corporation, if the capital is PHP 3,000.00 or more, then it should be registered with the SEC; conversely, if the capital does not exceed the aforementioned amount, then it should be registered with the DTI)

- BIR (for corporate taxation)

- LGUs of the location where you want to establish the partnership

- Barangay Hall

- Mayor’s Office

- Business Permit and Licensing Office (BPLO) of the Municipal/City Hall

- If employing individuals, a partnership should register with the following agencies:

- Social Security System (SSS)

- Philippine Health Insurance Corporation (PhilHealth)

- Home Development Mutual Fund (Pag-IBIG Fund)

*See table below for companies requiring endorsements from other government agencies

INVESTMENT VEHICLE: SOLE PROPRIETORSHIP

Types:

- Filipino-owned Sole Proprietorship

- Foreign-owned Sole Proprietorship – contrary to common belief, foreign entities can set up sole proprietorships in the Philippines as long as they meet the minimum capital requirement of US$ 200,000.00 and their proposed business activities do not fall under the areas of investment listed in the Foreign Investment Negative List (FINL) as partially or wholly restricted to foreign entities

Ownership Structure:

- Owned by a single individual who has full control and authority over the business, referred to as the sole proprietor and exclusively owns all assets and profits of the business; he or she is also personally liable for all the debts and losses that the business might incur

Government Agencies Involved in the Registration Process:

- Bureau of Trade Regulation and Consumer Protection of the DTI (for reservation of business name and creation of juridical entity of the sole proprietorship)

- BIR (for corporate taxation)

- LGUs of the location where you want to establish the sole proprietorship

- Barangay Hall

- Mayor’s Office

*See table below for companies requiring endorsements from other government agencies

INVESTMENT VEHICLE: COOPERATIVE

Types:

- Credit Cooperative – promotes and undertakes savings and lending services to create funds and grant loans for productivity and financial assistance among its members

- Consumer Cooperative – primary purpose is to procure and distribute commodities to both members and non-members

- Service Cooperative – engages in service-oriented activities such as medical, dental care, hospitalization, transportation, insurance, housing, labor, electric light and power, communication, and other such activities

- Producers Cooperative – undertakes joint production, for agricultural or industrial purposes

- Cooperative Bank – organized for the primary purpose of providing a wide range of financial services to cooperatives and their members

- Multi-Purpose Cooperative – combines two or more of the business activities listed above

Ownership Structure:

- Unlike corporations and partnerships, cooperatives have collective, democratic ownership and are run by an electoral system where all members elect officers through a one-member-one-vote principle

Government Agency Involved in the Registration Process:

- Cooperative Development Authority (CDA) (for the creation of juridical entity of the cooperative)

REGULATED BUSINESS SECTORS IN THE PHILIPPINES

Listed below are business sectors in the Philippines that require endorsement from specialized government agencies:

| Air Transport | Civil Aeronautics Board |

| Banks, Pawnshops or Other Financial Intermediaries with Quasi-Banking Functions | Bangko Sentral ng Pilipinas |

| Charitable Institutions | Department of Social Welfare and Development |

| Educational Institutions: (stock and non-stock) | |

| Department of Education |

| Commission on Higher Education |

| Technical Education Skills and Development Authority |

| Electric Power Plants | Department of Energy |

| Hospitals/Health Maintenance Organizations | Department of Health |

| Insurance | Insurance Commission |

| Neighborhood Associations | Housing and Land Use Regulatory Board |

| Professional Associations | Professional Regulation Commission |

| Radio, TV, and Telephone | National Telecommunications Commission |

| Recruitment for Overseas Employment | Philippine Overseas Employment Administration |

| Security Agency | Philippine National Police |

| Volunteer Fire Brigade | Bureau of Fire Protection |

| Water Transport/Shipbuilding/Ship Repair | Maritime Industry Authority |

Need Help in Registering Your Business in the Philippines?

BGC and Co. CPAs has registered hundreds of local and foreign companies in the Philippines. Our full spectrum of corporate services is guaranteed to help you enjoy a seamless business registration process.

BGC and Co. CPAs services include:

- Registering the sole proprietorship with DTI

- Securing local government registrations

- Sourcing out the commercial space

- Providing HR consulting and aid in drafting employee contracts

- Recruitment and executive search

- Outsourced accounting and bookkeeping services

- Payroll services

- Annual compliance

A sole proprietorship is a good way for an individual to set-up a business that will only participate in one or two primary objectives and have a very simple operation structure (e.g. small franchise, retail store). BGC and Co. CPAs can help you with the requirements and procedures to ensure the quick processing of your application and precipitate the commencement of your business.

BGC and Co. CPAs is a mid-sized progressive auditing firm providing comprehensive set of cost effective solutions to organizations like yours.

Our services include auditing, accounting, bookkeeping, business management, and HR consulting. Further, we provide other business services like VISA processing in Bureau of Immigration (BI), Philippine Retirement Authority (PRA).

We are equipped with state of art tools and techniques along with dedicated professional to evaluate potential opportunities and risks effective auditing and assurance services. We understand a value adding auditing and assurance service focus on scope of business improvement rather than merely preparing financial statements and reporting on figures.

The firm was formed to assist clients on the preparation of compliances relating to tax, financial management, forecasting and accounting software and system installation. Assist clients in tax investigations, internal auditing procedures and provide on financial, taxation, accounting and auditing matters when needed. Processing of business registration, cancellation / termination.

Our Mission

Deliver reliable cost effective professional services in time meeting specific customer requirements.

Our Vision

To become one of the best auditing and accounting firm in the Philippines providing the utmost satisfaction to all the clients. We would like to be known as one of the finest company to partnered with in all the aspects.

Our Team

Our teams of dedicated professionals led by senior qualified accountants are obliged to give you quality services which will enable you to serve your clients better and there by improve your business. We together with our associates enable to give you the best in the industry.

ABOUT OUR SERVICES

Auditing and Assurance

We are equipped with state of art tools and techniques along with dedicated professional to evaluate potential opportunities and risks delivering effective auditing & assurance services. We understand value adding auditing and assurance service focus on scope of business improvement rather than merely preparing financial statements and reporting on figures.

Our expertise in analyzing accounting systems, designing better systems with proper internal controls and management information reporting help our clients to adequately plan their business building strategy and give them the confidence to pace up with the rapidly growing economy.

Accounting and Bookkeeping

Accounting and bookkeeping is a necessity of every organization irrespective of its size. Our professionally qualified and experienced accountants understand and analyze business transactions and ensure compliance with the accounting standards. BGC has well trained staff familiar with many of the accounting system and most especially to the rapid changes in the BIR rules and regulations. Qualitative and timely accounting reports are crucial for the success of any business organization. BGC ensures relevant and reliable financial reports are delivered on regular intervals to assess performance and to facilitate decision making. Outsourcing of accounts department helps you to get professional expertise at lower cost and BGC provides the most efficient and effective bookkeeping solutions.

We assist you with below services:

• Accounts preparation and supervision

• Preparation and presentation of financial reports

• Bookkeeping services

• Payroll processing

• Training of accounting staff

Business Set-up and Termination

We do assist in setting up different types of business organizations through registrations to different government agencies such as:

• Securities and Exchange Commission (SEC);

• Bureau of Internal Revenue (BIR);

• Local Government Unit (LGU);

• Department of Trade and Industry (DTI);

• Social Security System (SSS);

• Philippine Health Insurance (Philhealth);

• Pag ibig;

• Food and Drug Administration (FDA)

We also assist our foreigner clients for the following:

• VISA extension;

• Bureau of Internal Revenue (BIR);

• 9g VISA;

• Special Resident Retiree’s VISA (SRRV)

• Social Security System (SSS);

• Passport Renewal

SERVICES

CONTACT US

ADDRESS

- 7TH FLOOR, PCCI CORPORATE CENTER, L.P. LEVISTE ST., SALCEDO VILLAGE, BRGY. BEL-AIR MAKATI, PHILIPPINES 1209

- Info@bgcco.ph

- lconvento@bgcco.ph

- Working Hours : 8:00 a.m - 5:00 p.m

PROFILE

AUTHORIZED INSTITUTION

在菲律宾成立公司:公司注册的选择

本地和外国投资者可以通过注册以下任何商业实体在菲律宾开展业务:独资企业、合伙企业、公司或合作社。如果您想注册一家公司,您可以在两种选择之间进行选择:注册一家新的国内公司或获得外国公司在菲律宾经营的许可证。

每种类型的商业实体都有自己的注册和注册流程、实收资本要求、税收义务、所有权结构和启动成本。此外,您应该与之协调的政府机构列表将根据您要注册的商业实体的类型而有所不同。

菲律宾的商业实体类型

投资工具:公司

类型:

股份公司——将股本分成股份并有权根据股份权益向此类股份、股息或配股的持有人分配业务利润的公司

国内公司(根据菲律宾法律组建)

100% 菲律宾人拥有

60% 菲律宾人拥有,40% 外资拥有

40.01% 至 100% 外商所有(受外商投资法的某些规定限制)

外国公司(根据公司原籍国的法律组建)

分支机构

代表处

地区总部(RHQ)

区域运营总部 (ROHQ)

非股份公司——既不产生利润也不向其成员发行股票的公司,并且可以有以下任何目的:

慈善;

宗教;

教育;

文化;

公民服务;和

其他类似目的,例如商会或组合贸易、工业或农业

股权结构:

国内公司必须由至少五 (5) 名但不超过十五 (15) 名注册人组成,他们必须单独认购至少一 (1) 股公司股份;公司成立人是公司章程中提到的最初组建和组成公司的股东或成员,并且是其签署人

外国公司若要获得在菲律宾作为商业实体经营的许可证,则需要指定一 (1) 名常驻代理人,该代理人应接受因在菲律宾发生的任何业务或交易而产生的所有传票或法律程序。菲律宾,给公司

参与注册过程的政府机构:

证券交易委员会(SEC)(用于创建公司的法人实体)

国税局 (BIR)(企业税)

您希望开展业务的地方的地方政府单位 (LGU)

描笼涯大厅

市长办公室

市政厅营业执照办(BPLO)

如果雇用个人,公司应在以下机构注册:

社会保障体系 (SSS)

菲律宾健康保险公司(PhilHealth)

家居发展共同基金(Pag-IBIG 基金)

*请参阅下表,了解需要其他政府机构认可的公司

投资工具:伙伴关系

类型:

普通合伙企业——两人或多人(通常称为普通合伙人)同意分享企业的所有资产、利润以及财务和法律责任的业务安排;普通合伙人可以参与合伙企业的日常管理,每个人都对合伙企业的行为承担无限责任,包括其他合伙人的行为

有限合伙——一种合伙类型,其中合伙人(通常称为有限合伙人)仅对其在合伙中的投资承担责任;与普通合伙企业不同,有限合伙人对公司的运营没有管理权或投入

股权结构:

可以由两 (2) 个或更多同意共同开展业务以营利的个人组成

参与注册过程的政府机构:

SEC 或贸易和工业部 (DTI)(用于创建合伙企业的法人实体;注册取决于公司的资本,如果资本为 3,000.00 菲律宾比索或更多,则应在 SEC 注册;反之,如果资本不超过上述金额,则应在DTI注册)

BIR(企业税)

您想建立合作伙伴关系的地方的 LGU

描笼涯大厅

市长办公室

市政厅营业执照办(BPLO)

如果雇用个人,合伙企业应在以下机构注册:

社会保障体系 (SSS)

菲律宾健康保险公司(PhilHealth)

家居发展共同基金(Pag-IBIG 基金)

*请参阅下表,了解需要其他政府机构认可的公司

独资企业注册 – 菲律宾

独资企业是由个人拥有的业务结构,该个人通常对业务具有完全控制权和权力。企业主被称为“独资经营者”,独家拥有企业的所有资产和利润。他或她还对企业可能产生的所有债务和损失承担个人责任。

作为菲律宾最简单的商业形式,独资企业的商业注册过程相对容易。独资企业也是最容易运营的,因为它们没有公司和合伙企业具有的相同手续和规定,例如董事会会议、董事会选举、股本等。

如何在菲律宾注册独资企业

由于法律将所有者和企业一视同仁,因此独资经营者只需在贸易和工业部 (DTI) 注册其姓名并获得当地执照和许可证即可开展业务。

以下是在菲律宾注册独资企业的分步流程:

在 DTI 注册企业名称以获得 DTI 注册证书;

在业务所在的 Barangay 办事处注册,以获得 Barangay 商业登记证书;

在市长办公室注册以获得市长许可证;和

在美国国税局 (BIR) 注册以获得注册证书。

独资企业的优势

需要最低限度的资金

政府机构的最低法规和合规要求

易于注册

独资经营者完全控制业务

易于管理,没有关于设立董事会、委员会或会议记录的必要手续或规定

独资经营者获得企业的所有资产和利润,可以自由混合企业和个人资产

独资企业的缺点

独资经营者对企业的债务、损失和责任承担无限的个人责任

独资经营者不能通过出售企业权益来筹集资金或通过既定渠道获得资金

个人收入和企业收入之间没有明确的定义,因为独资经营者对企业的所得税负有个人责任

独资企业很少能在所有者死亡或丧失行为能力的情况下幸存下来,因此不保值

企业破产影响业主个人

针对独资经营者的个人诉讼可能会消耗其所有个人资产并对企业的财务方面产生负面影响

对企业提起的诉讼也被视为对业主提起的诉讼;所有者或企业本身的债权人可以同时获得企业和所有者的个人资产,如果此类诉讼成功,所有者有义务用自己的钱支付损害赔偿

菲律宾的大多数小企业都是从独资企业开始的,随着它们成熟并增加利润,它们会发展到其他业务结构。由于菲律宾不像美利坚合众国、英国和新加坡等许多国家那样采用有限责任公司 (LLC) 或私人有限公司 (PLC) 的法律概念,因此菲律宾独资企业通常过渡到最接近的实体。是一家国内公司。国内或子公司是根据菲律宾公司法成立并受美国证券交易委员会 (SEC) 监管的一组法人。与独资企业不同,国内公司的法人实体与其公司所有者不同,因此个人资产与公司资产是分开的。负债也仅限于所有者的股本金额。

在菲律宾注册您的企业需要帮助吗?

BGC and Co. CPAs 已在菲律宾注册了数百家本地和外国公司。我们提供全方位的企业服务,保证帮助您享受无缝的企业注册流程。

想了解更多欢迎联系和咨询我们,中文 微信BGC998 电报@BGC998

更多延伸阅读